All Categories

Featured

Table of Contents

Protection amount selected will certainly coincide for all covered kids and may not go beyond the face amount of the base policy. Concern ages start at 30 days with less than 18 years of ages. Policy becomes exchangeable to a whole life plan between the ages of 22 to 25. A handful of factors influence exactly how much last cost life insurance policy you genuinely need.

Disclosures This is a general description of protection. A full declaration of protection is found just in the plan. For more details on coverage, expenses, restrictions, and renewability, or to obtain coverage, contact your neighborhood State Farm agent. There are constraints and problems concerning repayment of benefits as a result of misrepresentations on the application or when fatality is the result of suicide in the first 2 plan years.

Permanent life insurance coverage creates cash worth that can be obtained. The amount of money value available will typically depend on the kind of long-term plan bought, the amount of protection bought, the size of time the plan has actually been in pressure and any type of outstanding plan lendings.

Advantages Of Funeral Insurance

Additionally, neither State Farm neither its producers supply financial investment suggestions, except in specific restricted conditions relating to tax-qualified taken care of annuities and life insurance policy plans funding tax-qualified accounts. This plan does not assure that its proceeds will certainly be sufficient to pay for any specific solution or goods at the time of requirement or that solutions or product will certainly be offered by any type of specific provider.

The most effective way to make sure the plan quantity paid is invested where meant is to name a beneficiary (and, sometimes, a secondary and tertiary beneficiary) or to put your desires in an enduring will certainly and testimony. It is usually a great technique to notify key recipients of their expected responsibilities once a Final Expenditure Insurance plan is gotten.

Costs begin at $21 per month * for a $5,000 protection policy (costs will certainly differ based on concern age, sex, and insurance coverage quantity). No medical evaluation and no health and wellness concerns are needed, and consumers are ensured coverage through automatic credentials - american memorial burial insurance.

To find out more on Living Advantages, go here. Insurance coverage under Guaranteed Issue Whole Life insurance can typically be settled within 48 hours of initial application. Begin an application and buy a plan on our Surefire Concern Whole Life insurance coverage DIY page, or call 800-586-3022 to talk with a certified life insurance policy agent today. Listed below you will discover some regularly asked inquiries must you choose to request Final Expenditure Life Insurance Policy on your own. Corebridge Direct certified life insurance policy agents are standing by to answer any added concerns you might have concerning the security of your loved ones in case of your passing away.

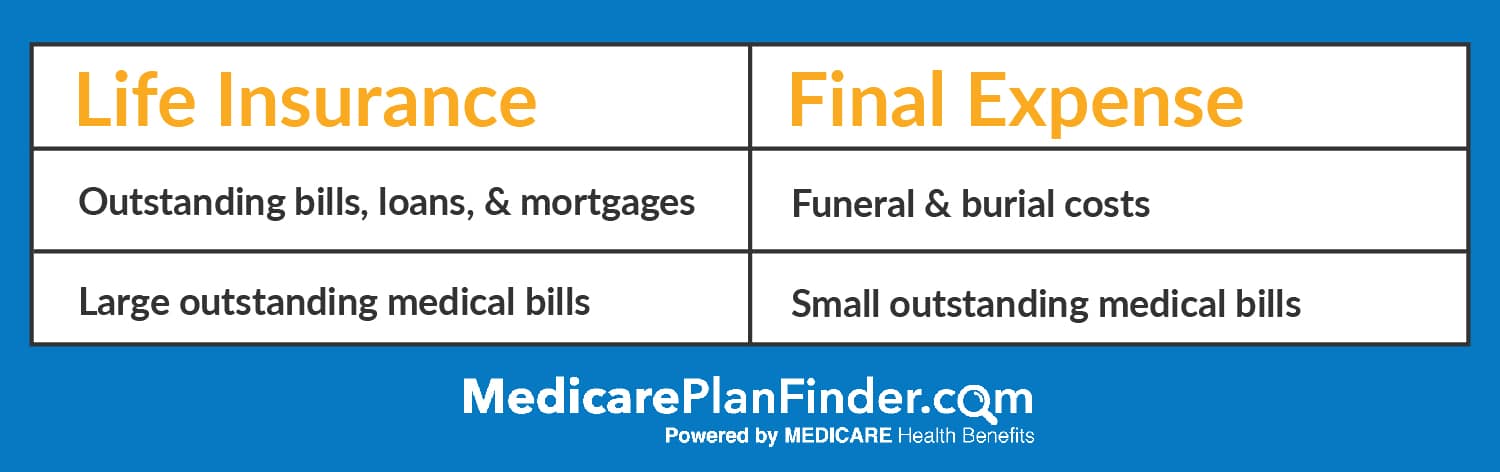

They can be made use of on anything and are created to assist the recipients prevent a financial dilemma when a liked one passes. Funds are usually used to cover funeral prices, medical bills, paying off a home mortgage, auto fundings, or even used as a savings for a brand-new home. If you have sufficient financial savings to cover your end-of-life costs, after that you may not need last expenditure insurance.

Additionally, if you've been unable to receive larger life insurance policy plans as a result of age or clinical conditions, a last expenditure policy may be an economical option that decreases the worry put on your household when you pass. Yes. Last cost life insurance is not the only method to cover your end-of-life costs.

Cheap Funeral Cover For Parents

These usually provide higher coverage quantities and can protect your family's way of living along with cover your last expenses. Connected: Entire life insurance coverage for senior citizens.

The application process is quick and easy, and insurance coverage can be provided in days, occasionally also on the day you use. When you have actually been approved, your insurance coverage begins right away. Your plan never ever expires as long as your premiums are paid. Final cost policies can develop money value in time. As soon as the cash money worth of your policy is high enough, you can take out cash from it, use it to obtain money, and even pay your costs.

Final Expense Insurance Virginia

There are a number of expenses related to a death, so having last expenditure coverage is important. A few of the fundamentals covered consist of: Funeral plans, including embalming, coffin, flowers, and solutions Burial costs, consisting of cremation, interment plot, headstone, and interment Exceptional medical, legal, or charge card expenses Once the funds have been paid out to your recipient, they can make use of the cash any type of method they desire.

Just be sure you select a person you can rely on to allocate the funds correctly. Progressive Solutions - selling final expense life insurance is your resource for all things life insurance policy, from just how it functions to the sorts of policies available

This survivor benefit is generally related to end-of-life expenses such as clinical expenses, funeral costs, and a lot more. Picking a final expense insurance option is among the several steps you can take to prepare your household for the future. To help you better recognize the ins and outs of this sort of entire life insurance coverage plan, allow's take a more detailed consider just how final expense insurance policy functions and the sorts of policies that might be offered for you.

Not every last cost life insurance coverage policy is the exact same. burial insurance seniors. A prompt or common final expense insurance plan enables for recipients to obtain full fatality benefits no issue when or just how the insurance holder passed away after the beginning of the insurance policy.

A graded advantage plan may have it so that if the insured passes throughout the first year of the plan, up to 40 percent of the advantage will certainly be given to the beneficiaries. If the insured dies within the second year, up to 80 percent of the advantages will most likely to the recipients.

Final Expense Insurance Sales

An assured concern final cost insurance plan calls for a 2- to three-year waiting period before being eligible to get benefits. If the insured individual passes away before completion of this waiting period, the recipients will not be qualified to get the survivor benefit. However, they might obtain a return of the costs that have been paid with rate of interest.

Depending on your wellness and your funds, some policies might be much better matched for you and your household over the various other alternatives. In basic, last expense life insurance policy is fantastic for anybody seeking an inexpensive policy that will certainly help cover any impressive equilibriums and funeral prices. The cost of premiums has a tendency to be less than typical insurance coverage, making them quite inexpensive if you are seeking something that will certainly fit a limited spending plan.

Burial Policy Cost

A prompt final expenditure policy is a good choice for anyone who is not in excellent health because recipients are qualified to obtain advantages without a waiting duration. A study on the health and wellness and case history of the policyholder may determine how much the premium on this policy will be and influence the survivor benefit amount.

A person with serious health and wellness conditions might be rejected various other kinds of life insurance policy, but an ensured issue plan can still give them with the insurance coverage they require. Planning for end-of-life expenditures is never ever a satisfying discussion to have, but it is one that will help your family when facing a tough time.

Sell Final Expense Insurance Over The Phone

It can be uncomfortable to think regarding the costs that are left behind when we die. Failing to prepare in advance for an expenditure might leave your household owing countless dollars. Oxford Life's Assurance final expenditure entire life insurance coverage plan is an economical means to assist cover funeral expenses and other costs left.

Table of Contents

Latest Posts

Senior Funeral Insurance

Burial Mutual Of Omaha

Cheapest Final Expense Insurance

More

Latest Posts

Senior Funeral Insurance

Burial Mutual Of Omaha

Cheapest Final Expense Insurance